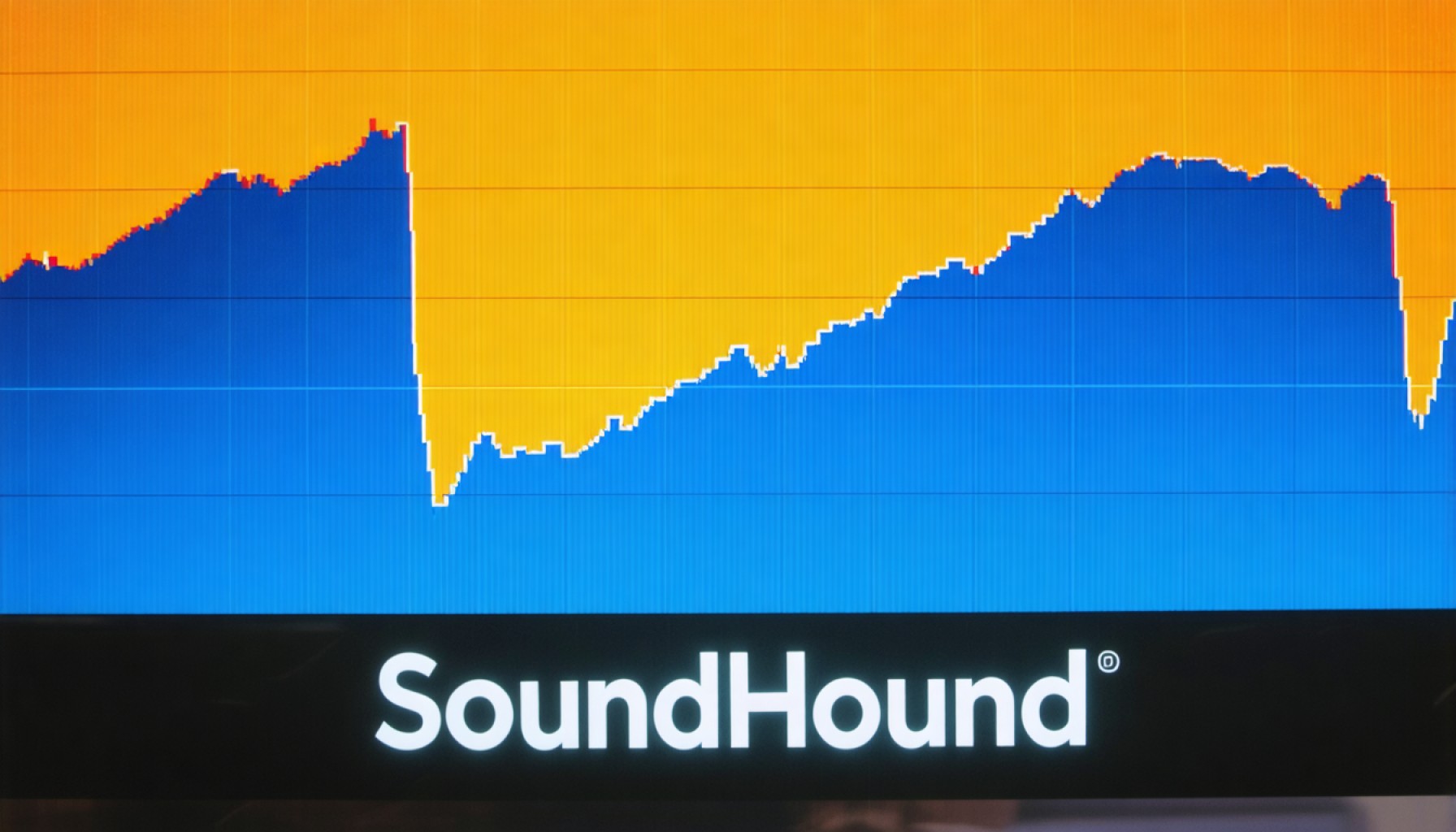

- SoundHound AI, Inc’s Class A stock is experiencing significant volatility, capturing considerable market attention.

- Call options have surged to over 20,250 trades, with implied volatility spiking to 103.72%.

- The Put/Call Ratio is at 0.19, indicating strong bullish sentiment among investors.

- May 8th is a pivotal date, marking the release of SoundHound’s latest earnings report, which could significantly impact the stock’s future.

- DA Davidson has adjusted its price target from $13 to $10, reflecting cautious optimism amid potential economic pressures.

- Despite a 54.61% year-to-date decline, SoundHound remains part of the Russell 2000 index, with a market cap of $3.67 billion, suggesting resilience and growth potential.

- Analysts advise vigilance as the stock remains a compelling case study in market volatility and investor interest.

SoundHound AI, Inc’s Class A stock isn’t just moving—it’s practically pirouetting on center stage. Investors and market-watchers have found themselves captivated by the stock’s unusual volatility as it swings with wild, unpredictable energy. Recently, this tech player has been thrust into the spotlight, not just for its core offerings in artificial intelligence, but due to a dizzying display of market theatrics.

Picture a bustling trading floor as SoundHound’s stock captures traders’ attentions; the call options alone have traded at over 1.6 times the expected volume, soaring past 20,250 trades. Investors aren’t just interested—they’re enthusiastic, inciting the implied volatility to spike to an eye-catching 103.72%. It’s as if the market collectively holds its breath for the next revelation in SoundHound’s journey.

The fateful date that everyone circles in red is May 8th—the day SoundHound is set to unveil its latest earnings report. The anticipation is palpable and the telling of this financial chapter could pivot the stock’s trajectory dramatically. Bolstering this frenzy of optimism is the Put/Call Ratio, resting at a mere 0.19—suggesting a clear bull-run rallying cry from the trading community.

Yet, amidst the buzz, storm clouds loom. DA Davidson, ever the cautious observer, has adjusted its price target from a sky-high $13 to a more grounded $10. This conservative recalibration considers external pressures—tariffs, economic conditions—that could cast a shadow over the otherwise bright prospects.

SoundHound’s presence in the Russell 2000 index reminds us that despite current setbacks—a 54.61% year-to-date price decline—there may still be room for growth. A technical sentiment signal says “sell,” but seasoned analysts advise watching this stock closely. Its current market cap sits at a formidable $3.67 billion, standing testament to its potential and resilience.

In the high-stakes arena of stock trading, SoundHound AI, Inc Class A remains a subject of fascination. It’s a compelling case study in volatility that underscores the thrilling, sometimes precarious, dance that is the financial market. As investors take their positions and the clock ticks towards May 8th, all eyes remain on this electrifying act, wondering how the music will play out.

Why SoundHound AI, Inc’s Stock is the Talk of the Market

The recent whirlwind surrounding SoundHound AI, Inc’s Class A stock is more than just a lively market event; it’s a reflection of the intricate dance between innovation, volatility, and investor sentiment. While the excitement is palpable, digging deeper reveals a multi-layered narrative ripe with opportunity and caution. Here’s what every savvy investor should know about this daring tech player and its unfolding market journey.

In-Depth Analysis of SoundHound’s Market Position

1. Opportunities and Innovations in AI:

SoundHound has carved out a niche in the competitive world of artificial intelligence by focusing on voice AI technology. This positions the company as a contender in the ever-expanding AI industry, where automation and machine learning continue to drive innovation. According to Gartner, the AI market is expected to reach $126 billion by 2025, presenting significant growth opportunities for companies like SoundHound.

2. Market Volatility and Option Trades:

SoundHound’s stock volatility is a double-edged sword. The high volume of call options indicates that investors are bullish on its future, potentially expecting upward price movement. However, such volatility also brings increased risk. An implied volatility of 103.72% signals that large price swings, either up or down, could occur. Investors should monitor option volumes and ratios closely.

3. Analysts’ Forecast and Price Target Adjustments:

DA Davidson’s adjustment of the stock’s target price from $13 to $10 hints at cautious optimism. It reflects the market’s acknowledgment of potential growth hurdles amid broader economic conditions. Investors should consider such forecasts as one part of a broader analysis, factoring in diverse economic conditions and intrinsic company value.

Essential Considerations for Investors

1. Price Decline and Market Sentiment:

Despite the stock’s 54.61% year-to-date price decline, its inclusion in the Russell 2000 index highlights its small-cap growth potential. Investors should watch out for sentiment shifts that could offer buying opportunities, especially post-earnings announcements.

2. Technical Analysis and Long-term Viability:

The current technical indicator suggesting a “sell” aligns with the stock’s volatility but might not reflect long-term outcomes. Investors are advised to consider fundamental analysis alongside technical signals to ascertain intrinsic value and growth potential.

Practical Steps for Potential Investors

– Diversify Investments: Reduce risk by diversifying across different sectors and asset classes. While SoundHound presents significant opportunities, balancing it with stable investments can mitigate potential losses.

– Stay Informed: Regularly follow credible financial news outlets such as Bloomberg and market analysis from trusted platforms to stay ahead of trends and updates on SoundHound’s performance.

– Set Clear Investment Goals: Determine your investment horizon and risk tolerance. SoundHound’s volatility may appeal to short-term traders looking for quick profits but can pose risks to long-term investors seeking steady growth.

Final Thoughts

SoundHound AI, Inc’s journey in the stock market is a testament to the fast-evolving nature of tech stocks that are contingent on innovation and market sentiment. By staying informed and strategically balancing risk, investors can position themselves advantageously in this fluid market landscape. As we approach the upcoming earnings report on May 8th, proactive preparation and informed decision-making will be key to navigating the thrilling uncertainties of the financial markets.